maryland earned income tax credit stimulus

If you qualify for the federal earned. Web After Fridays vote Marylanders without children who earn no more than 15820 a year including undocumented residents can collect the credit starting this tax year.

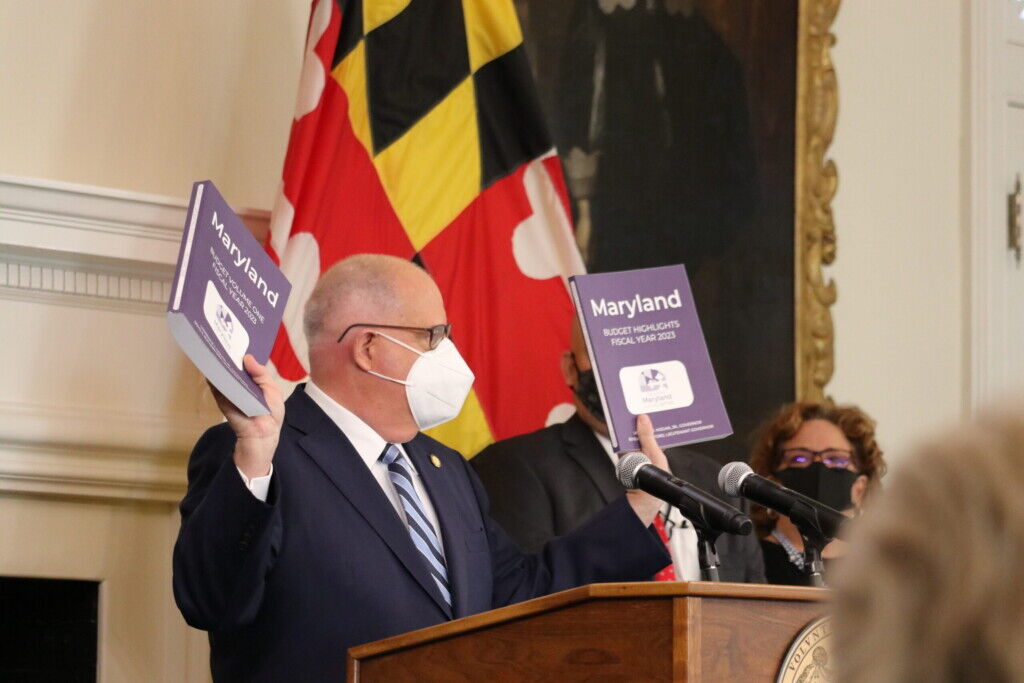

Gov Larry Hogan Announces 1b Covid 19 Relief Act Includes 750 Income Tax Credit For Maryland Families Cbs Baltimore

See Worksheet 18A1 to calculate any refundable earned.

. Web The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. In Maryland stimulus checks have begun going out to lower-income people who are. Web required to file a tax return.

Web This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit followed by a second-round stimulus for EITC. Web Maryland approves coronavirus relief bill that would greatly expand Earned Income Tax Credit. Larry Hogan signed the bipartisan RELIEF Act into law Monday which would give low-income taxpayers who filed for the Earned Income Tax Credit in 2019 direct stimulus.

Web The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. Tax Alert 03-11-2021 Extension of Time to File and Waiver of Interest and Penalty for Certain Filers. If you qualify you can use the credit to reduce the taxes you.

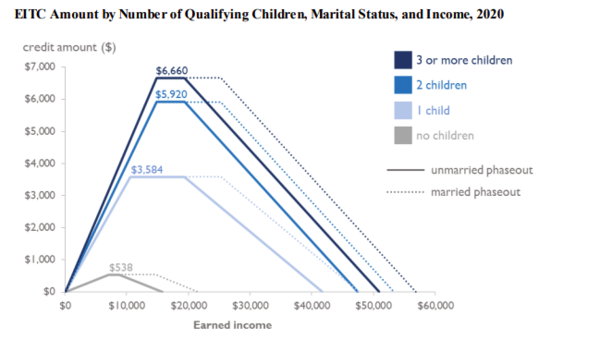

CASH Campaign of Maryland 410-234-8008 Baltimore. Web The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break. Web Marylanders who made 57000 or less in 2020 may qualify for both the federal and state Earned Income Tax Credits as well as free tax preparation by the CASH Campaign of.

For 2022 the Child Tax Credit CTC reverts back to the rules we saw in 2020. The Maryland State House in Annapolis. 1 General Info.

The measure which is modeled after the. Web To qualify for a stimulus payment you must have a valid Social Security number and received the Maryland Earned Income Credit EIC on your 2019 Maryland state tax. Web Tax Alert - Maryland RELIEF Act 4202021 - Superseded.

Web The IRS said it began mailing the letters in mid-October to reach millions of people who havent claimed benefits such as stimulus checks the expanded Child Tax Credit and. Maryland United Way Helpline dial 211 or 1- 800-492-0618 and the TTY line is 410-685-2159. Web The Maryland Governors office say that the bill includes immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit.

Answer some questions to see if you qualify. Hogan Jrs R billion-dollar relief package relied on the Earned Income Tax Credit EITC to provide direct stimulus payments for low-income Marylanders hit. 2022 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

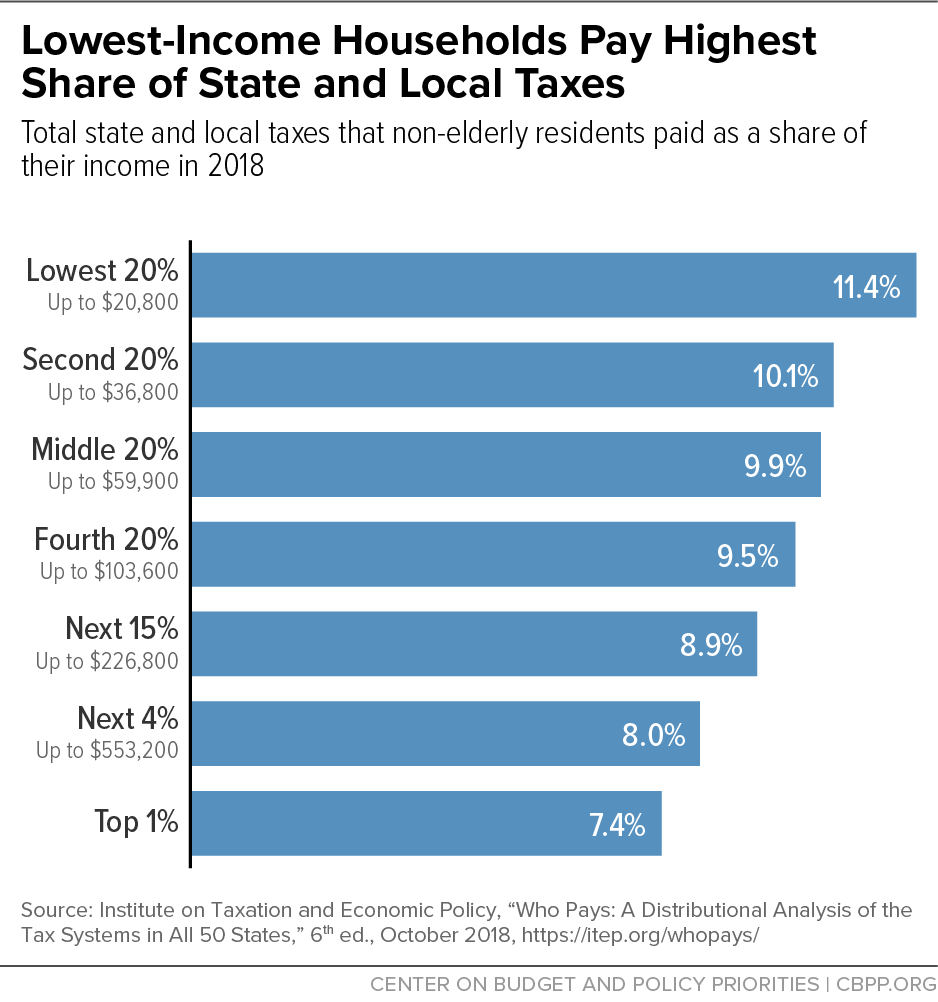

Web Taxpayers without a qualifying child may claim 100 of the federal earned income credit or 530 whichever is less. This is the third round of stimulus checks signed off on by lawmakers during the pandemic. Web The earned income tax credit is praised by both parties for lifting people out of poverty.

Web IR-2022-199 November 15 2022. Web 2021 Recovery Rebate Credit. It provides up to 1400 per qualifying person including.

Which means no one receives advance monthly payments and the total credit amount is. Will NewtonFor The Washington Post. Web DIRECT STIMULUS PAYMENTS FOR LOW TO MODERATE-INCOME MARYLANDERS This relief begins with immediate payments of 500 for families and 300 for individuals.

WASHINGTON The Internal Revenue Service today reminded those who still need to file their 2021 tax returns that IRS Free File remains. Web In the recently passed stimulus bill Maryland expanded its earned income tax credit to become the most generous in the country.

Earned Income Tax Credit Wikipedia

The Latest Maryland Tax Relief Package Aims To Help Families Small Businesses And Retirees With Additional Tax Savings And Stimulus Travis Raml Cpa Associates Llc

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

Earned Income Tax Credit Changes H R Block

1b Coronavirus Relief Act Signed In Maryland Taxes For Expats

Maryland Relief Act Poised To Help Low To Moderate Income Marylanders Politics Wboc Com

Maryland S Relief Proposal Amended To Provide Broader Stimulus Checks Maryland Matters

Some Marylanders Criticize State S Stimulus Qualifications Wusa9 Com

Maryland S State Income Tax Filing Deadline Extended To July 15 Business Wboc Com

Expanding The Earned Income Tax Credit Can Support Older Working Americans Urban Institute

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Maryland Relief Act Signed Into Law

Maryland Relief Act Payments Being Processed This Week

Comptroller To Unemployment Insurance Recipients Prepare For Higher Tax Bill Conduit Street

Hogan Introduces 58 2 Billion Budget Including Tax Relief Proposals Wtop News

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Earned Income Tax Credit Wikipedia

Tweets With Replies By Comptroller Of Maryland Shopmd Mdcomptroller Twitter